Moving to Maine?

Are you moving to Maine or another state, and enrolled in Medicare?

Moving can be a stressful time and you have a lot of things to change and update. You will want to make sure your Medicare and Social Security benefits continue smoothly so here is some important information that I hope will help make it easier.

First, what kind of Medicare plan do you have?

Lettered Plans (Plan G, Plan F, Plan N, etc…)

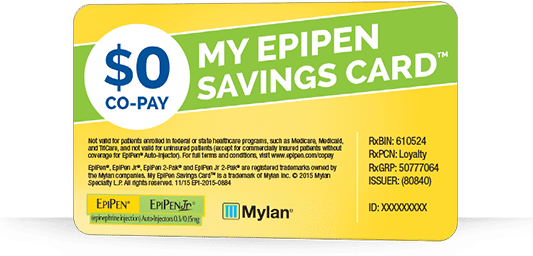

If you have a Medicare Part D Prescription Drug Plan, with a Medicare Supplement plan that is a “lettered plan” which works in combination with Original Medicare and you move to another state, you will most likely be able to keep the same supplement policy but you will have to change your Part D plan.

When to start shopping for a new plan.

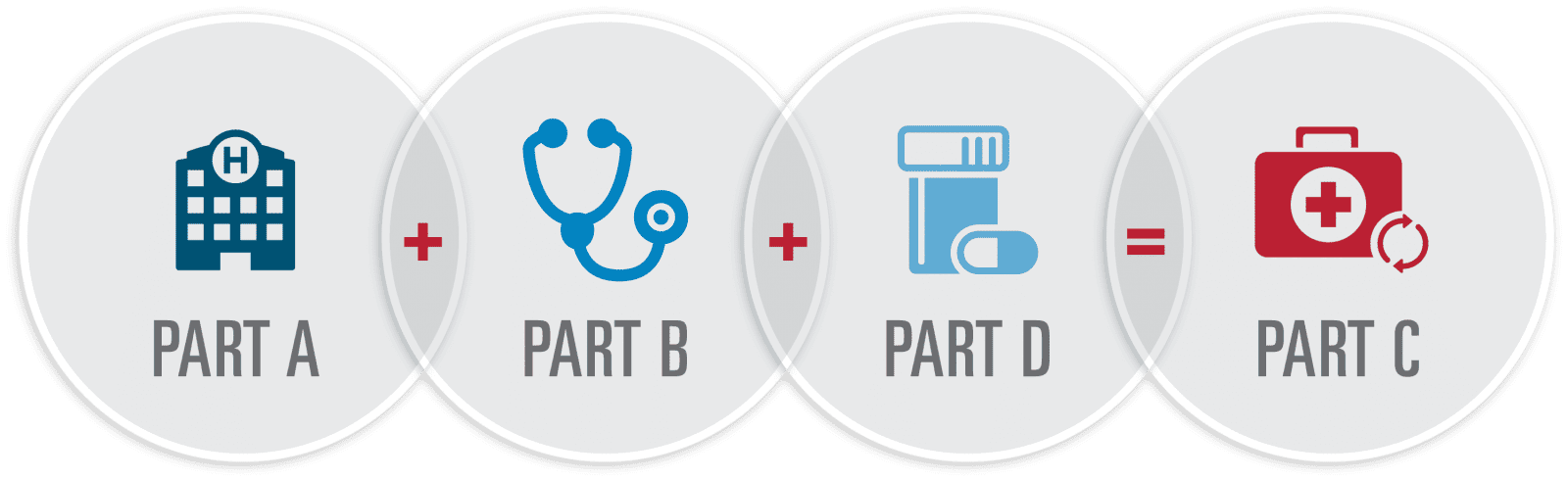

If you’re enrolled in a Medicare Advantage plan under Part C of Medicare, a change in residence, such as moving to another state, could qualify you for a Special Election Period (SEP). During this period of time, you are able to find a new plan that is offered in your new home.

If you permanently move somewhere that your current Medicare plan does not cover (outside the service area), you should call your insurance company immediately and begin looking for a new plan. The phone number for customer service is located on the back of your insurance card.

If you permanently move somewhere that your current Medicare plan does not cover (outside the service area), you should call your insurance company immediately and begin looking for a new plan. The phone number for customer service is located on the back of your insurance card.

If you call your insurance company before you move and tell them you are moving, you will have one month before the month you move and three more months after you move to find a new plan but your insurance company may end your coverage at the end of the month that you move. So be sure to ask when your plan will end.

If you notify your plan after you move, you can switch plans the month you provided notice of the move and up to two months after that. Again, your insurance company may end your coverage at the end of the month, so it’s important to ask when it will end.

Medicare Advantage or Part C

If your current insurance plan is not offered in the new area, your plan is required by Medicare to dis-enroll you. If you don’t enroll in a new Medicare Advantage plan during your SEP, you’ll return to Original Medicare (Part A and Part B).

If you miss this window and do not choose a new plan before it ends you may have to wait for the Annual Election Period (October 15 – December 7) and your coverage will begin January 1st.

Medicare Part D Prescription Drug Plan

The same rules for the Medicare Advantage plans above apply to your Part D plan. If you don’t enroll in a new Medicare Prescription Drug Plan during your enrollment window, you might find yourself without Medicare prescription drug coverage, and you could face a Medicare Part D late-enrollment penalty if you pick up this coverage later on.

The same rules for the Medicare Advantage plans above apply to your Part D plan. If you don’t enroll in a new Medicare Prescription Drug Plan during your enrollment window, you might find yourself without Medicare prescription drug coverage, and you could face a Medicare Part D late-enrollment penalty if you pick up this coverage later on.

You may be able to enroll in a stand-alone Medicare Part D Prescription Drug Plan, or to get your Medicare coverage through a Medicare Advantage Prescription Drug plan – but if you don’t do it within a couple months of your move, you may miss your opportunity to change and would have to wait for the Annual Election Period (October 15 – December 7). Again, if you enroll in a new plan during this period your coverage will not begin until January 1st.

What if you move to an address that’s still within your plan’s service area, but where new Medicare Advantage or Medicare Prescription Drug Plan options are available to you?

This will also qualify you for a Special Election Period. You may use this SEP to enroll into the new plan that is offered in your new service area or do nothing and remain on your current plan.

When should I notify Social Security about my address change?

Make sure you notify Social Security of your change of address. The Social Security Administration handles Medicare enrollment. You can change your address by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) and speak to one of their representatives from Monday through Friday, from 7AM to 7PM. You can also visit the Social Security office nearest you and fill out a change of address form or visit them online at www.ssa.gov

Make sure you notify Social Security of your change of address. The Social Security Administration handles Medicare enrollment. You can change your address by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) and speak to one of their representatives from Monday through Friday, from 7AM to 7PM. You can also visit the Social Security office nearest you and fill out a change of address form or visit them online at www.ssa.gov

How do I find a new plan?

You can use the Planfinder tool on the Medicare.gov website and put in your new zipcode and list out all your medications and the tool will give you a list of plans in that area that cover your drugs. This is just very basic information based strictly on the financial costs.

To find out the details on how the plans work and what doctors and hospitals accept the plan you will have to call each insurance company directly and ask the right questions.

Or …

You can call me and save yourself the time and headache. I will help you review all the plans available to you and I will explain each one and how it works. I have many clients who are using the different plans out there and I know from talking to them which plans have the best customer service and which are easiest to use. I can help you like I have helped all of them. Give me a call today. I will be happy to help you. My number is 207-370-0173.

Best of all – it does not cost you anything!

I do not charge anyone for my help, whether you enroll with me or not. I get paid by the insurance company when I deliver your application so once we pick the right plan I will help you fill out the application and I will turn it into the insurance company for you. I get paid for helping you and it does not cost you anything. You do not pay higher rates or any additional costs. You pay the same rate as everyone else whether I help you or not. So, why not get some great advice and benefit from my experience?

Are you turning 65 and still working? Read this.

It will not, however, pay for any follow-up dental care after the underlying health condition has been treated. So, if Medicare paid for a tooth to be removed as part of surgery to repair a facial injury, do not expect Medicare to pay for any other dental care you may need later because you had the tooth removed, and Medicare will not pay for dental implants or dentures to replace the extracted tooth.

It will not, however, pay for any follow-up dental care after the underlying health condition has been treated. So, if Medicare paid for a tooth to be removed as part of surgery to repair a facial injury, do not expect Medicare to pay for any other dental care you may need later because you had the tooth removed, and Medicare will not pay for dental implants or dentures to replace the extracted tooth.

Some Medicare Advantage Plans Include Dental Coverage

Some Medicare Advantage Plans Include Dental Coverage

Like the song says, “You better shop around!”

Like the song says, “You better shop around!”

After reviewing these plans she tells me which one she likes best and we fill out the application together. While I’m filling out the application I ask if her co-workers threw her a retirement party and she tells me that since she is head of the party planning committee she actually had to plan her own party. She tells me some stories about this horrible woman named Angela that she worked with but in the end she’s really going to miss everyone there, even Angela.

After reviewing these plans she tells me which one she likes best and we fill out the application together. While I’m filling out the application I ask if her co-workers threw her a retirement party and she tells me that since she is head of the party planning committee she actually had to plan her own party. She tells me some stories about this horrible woman named Angela that she worked with but in the end she’s really going to miss everyone there, even Angela.