Vitamins and Supplements

More and more of my clients are asking about coverage for vitamins and dietary supplements because their doctors are recommending vitamins and nutritional supplements, such as vitamin D and calcium.

Original Medicare doesn’t cover vitamins and supplements. However some of the insurance plans do offer coverage for them.

If you have a Medigap and a Stand-alone Part D Prescription Drug Plan

Some Medicare Prescription Drug Plans will cover certain vitamins and supplements. Every Medicare Prescription Drug Plan has its own list of covered drugs called a formulary. Check your plans formulary to see what is covered.

In general, Medicare Prescrption Drug Plans will not cover vitamin supplements. But Part D plans that have “enhanced alternative coverage” included in their benefits may include coverage for some vitamins and supplements. Enhanced alternative coverage means the plan’s formulary contains additional items that go beyond the standard Medicare Part D coverage.

You should contact the agent who helped you find your plan to find out if it offers enhanced alternative coverage and what, if any, prescription vitamins and supplements are covered.

A plan’s formulary may change from year to year. Each year you will receive notice of plan changes and it’s a good idea to review those changes and talk to your agent if you have any questions or concerns.

Feel free to contact me if you would like to learn more about your Medicare coverage and options. I am always happy to answer questions.

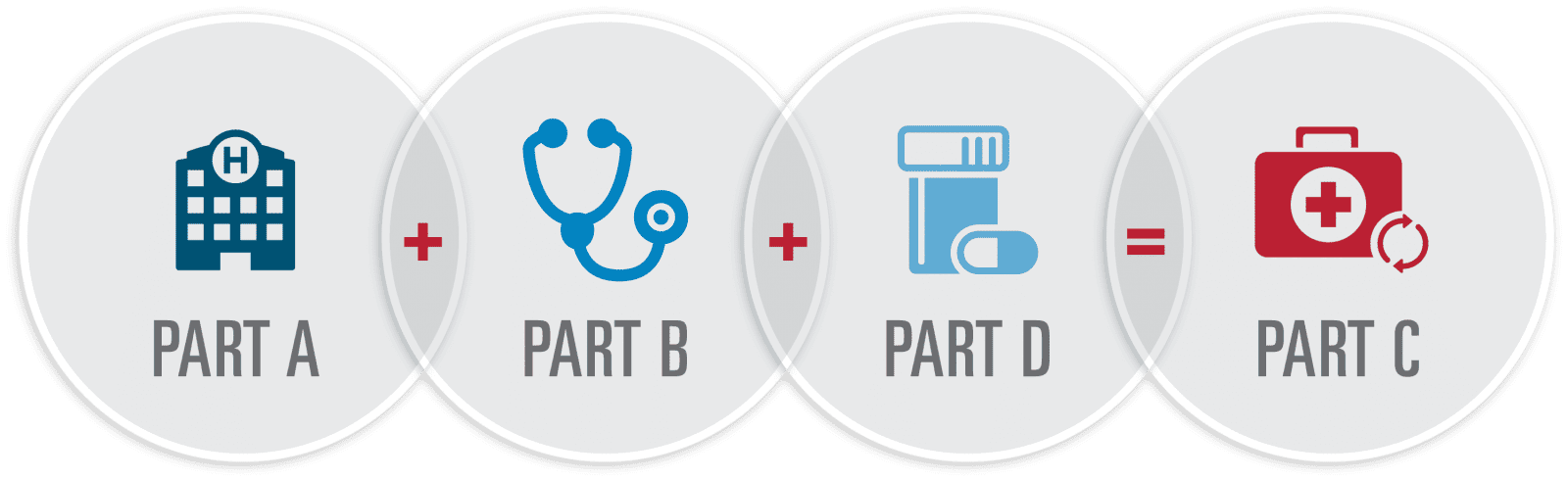

If you have a Medicare Advantage Plan (MA-PD)

Sometimes referred to as a Part C plan, Medicare Advantage plans have your prescription drug coverage built into the plan. These all-in-one plans also sometimes offer other the counter drug benefits as well as enhanced alternative coverage. To access the over-the-counter (OTC) benefit you usually have a cataloge of covered items, such as vitains, aspirin, cough syrup, antacidis, bandages, cotton swaps and more expensive things like heating pads or incontience supplies.

Generally the plans that offer this type of coverage give you a set dollar amount ($200 per year, $50 per quarter or $25 or $40 per month) and you simply order each month from the catalog and they ship it to free of charge.

If you would like to know if your plan includes these benefits you can give me a call at (207) 370-0143 or reach out to me via email using the CONTACT button on the menu at the top of this webpage.

And if you have any questions about this topic or need help finding a better plan or making a change, I will be happy to help you.

And it won’t cost you anything!

I do not charge anyone the assistance that I provide. I am an independent agent so I don’t work for the insurance company. I work for you. Just like your car insurance agent – I help you search all the different compaies to find the best price and the best coverage. I help you fill out the application and then turn it into the insurance company and follow up on it for you. If there are any difficulties I help you thtough them. Working with me makes Medicare easy!

Are you turning 65 and still working? Read this.

That’s right. You can still make the changes you need. But you must act quickly because each different plan has a different timeline on when the changes can be made.

That’s right. You can still make the changes you need. But you must act quickly because each different plan has a different timeline on when the changes can be made.

My goal is to help people and I have found great joy in being able to offer my expertiese and knowlege to people who need my help.

My goal is to help people and I have found great joy in being able to offer my expertiese and knowlege to people who need my help.

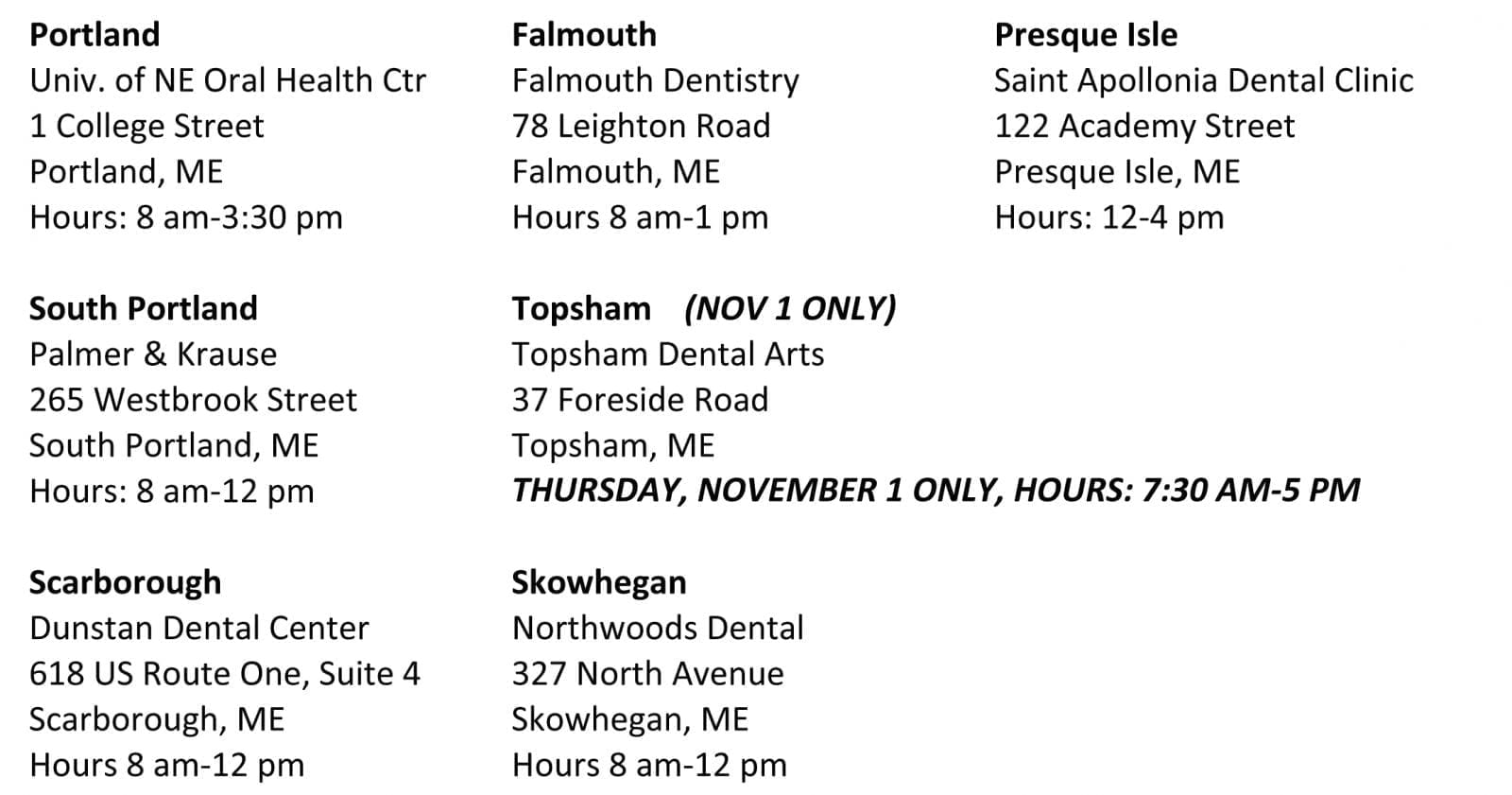

If you miss this event or if there is no dentist in your area participating, check to see if your current medicare plan offers any dental coverage. [

If you miss this event or if there is no dentist in your area participating, check to see if your current medicare plan offers any dental coverage. [

Be sure to read your Annual Notice of Change Letter (ANOC) that should arrive in the mail each year at the beginning of October to see how your plan is increasing – this may help you determine how much you need to budget in 2019 to cover the costs of coverage.

Be sure to read your Annual Notice of Change Letter (ANOC) that should arrive in the mail each year at the beginning of October to see how your plan is increasing – this may help you determine how much you need to budget in 2019 to cover the costs of coverage.

You can quickly become overwhelmed with all the choices and information – and that usually results in choosing the wrong plan!

You can quickly become overwhelmed with all the choices and information – and that usually results in choosing the wrong plan!

The plans offering gym reimbursements are the most popular because they allow you to join the local gym that is nearby your home.

The plans offering gym reimbursements are the most popular because they allow you to join the local gym that is nearby your home.

If you permanently move somewhere that your current Medicare plan does not cover (outside the service area), you should call your insurance company immediately and begin looking for a new plan. The phone number for customer service is located on the back of your insurance card.

If you permanently move somewhere that your current Medicare plan does not cover (outside the service area), you should call your insurance company immediately and begin looking for a new plan. The phone number for customer service is located on the back of your insurance card.

The same rules for the Medicare Advantage plans above apply to your Part D plan. If you don’t enroll in a new Medicare Prescription Drug Plan during your enrollment window, you might find yourself without Medicare prescription drug coverage, and you could face a Medicare Part D late-enrollment penalty if you pick up this coverage later on.

The same rules for the Medicare Advantage plans above apply to your Part D plan. If you don’t enroll in a new Medicare Prescription Drug Plan during your enrollment window, you might find yourself without Medicare prescription drug coverage, and you could face a Medicare Part D late-enrollment penalty if you pick up this coverage later on. Make sure you notify Social Security of your change of address. The Social Security Administration handles Medicare enrollment. You can change your address by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) and speak to one of their representatives from Monday through Friday, from 7AM to 7PM. You can also visit the Social Security office nearest you and fill out a change of address form or visit them online at

Make sure you notify Social Security of your change of address. The Social Security Administration handles Medicare enrollment. You can change your address by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) and speak to one of their representatives from Monday through Friday, from 7AM to 7PM. You can also visit the Social Security office nearest you and fill out a change of address form or visit them online at

Step 3 – Cancel over the phone!

Step 3 – Cancel over the phone! Step 4 – Protect yourself!

Step 4 – Protect yourself! If you call after the 15th of the month before you start your Medicare insurance then your coverage will end on the last day of the next following month. This is why is so important to begin this process 3 months before your 65th birthday!

If you call after the 15th of the month before you start your Medicare insurance then your coverage will end on the last day of the next following month. This is why is so important to begin this process 3 months before your 65th birthday!