Medigap vs. Medicare Advantage

“What’s the differences between Medicare Supplements and Medicare Advantage?”

Questions like this are the reason I do what I do. You need to know what your options are in Maine when you turn age 65 and enroll in Medicare – and there are a lot of options!

There are many differences between Medicare Supplement plans or Medigap as they are called in the Medicare literature.

One difference between Medigap and Medicare Advantage plans is that Medicare Advantage contracts operate on a calendar year basis and can have changes from year to year just like the health insurance plan you had prior to Medicare. Medicare Supplement policies are standardized and are the same year after year.

Feeling overwhelmed? Get local help. Click here.

Another difference is the cost. Medicare Advantage Plans generally have much lower monthly premiums (sometimes $0) And some Medicare Advantage plans pay you! (Yes you read that right!) Medigap plans can cost much more, often in the $200/month range.

With Medicare Advantage plans you are required to share in your medical costs by paying co-pays as you use the plans. These plans operate very similar to the Medical insurance you may have had before you retired if you had an HMO or a PPO plan on the Healthcare marketplace (Obamacare) or with an employer. Most Medigap plans have very small out of pocket costs while they cost much more up front.

This is why most people turning 65 or planning retirement choose to meet with someone like myself who has the knowledge and experience with the different plans and can help you decide which plan is best for you. Choosing between these two types of Medicare insurance plans is just the first step.

Once you’d decided on Medigap or Medicare Advantage then you must choose which Medigap plan or which Medicare Advantage plan best fits your needs. You may also need to pick a separate Part D prescription drug plan if the plan you choose does not include drug coverage.

Also, the best plan for you may not always be the best plan for your spouse so you will have to do the same research for both of you. I can explain everything you need to know so that you can make the best choice. You can schedule a meeting quickly and easily using this button.

If you have a question that needs to be answered right away, just give me a call. My number is (207) 370-0143 or call toll free 866-976-9038.

Want to know more?

If you would like help comparing your needs against the many Medicare plans out there or if you just want to ask a few questions, you can call me directly at 207-370-0143 or use my simple form on the CONTACT page of this site to send an email message.

The best part about working with me is that it will not cost you anything to talk with me to discuss your options and review the plans that are available. I am paid by the insurance companies in the form of a commission when you enroll in a plan. You will not pay anything to meet with me and you will pay the same price for your insurance that everyone pays whether they had my help or not.

“My goal is to help people and I have found great joy in being able to offer my services to people who need my help.”

If you permanently move somewhere that your current Medicare plan does not cover (outside the service area), you should call your insurance company immediately and begin looking for a new plan. The phone number for customer service is located on the back of your insurance card.

If you permanently move somewhere that your current Medicare plan does not cover (outside the service area), you should call your insurance company immediately and begin looking for a new plan. The phone number for customer service is located on the back of your insurance card.

The same rules for the Medicare Advantage plans above apply to your Part D plan. If you don’t enroll in a new Medicare Prescription Drug Plan during your enrollment window, you might find yourself without Medicare prescription drug coverage, and you could face a Medicare Part D late-enrollment penalty if you pick up this coverage later on.

The same rules for the Medicare Advantage plans above apply to your Part D plan. If you don’t enroll in a new Medicare Prescription Drug Plan during your enrollment window, you might find yourself without Medicare prescription drug coverage, and you could face a Medicare Part D late-enrollment penalty if you pick up this coverage later on. Make sure you notify Social Security of your change of address. The Social Security Administration handles Medicare enrollment. You can change your address by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) and speak to one of their representatives from Monday through Friday, from 7AM to 7PM. You can also visit the Social Security office nearest you and fill out a change of address form or visit them online at

Make sure you notify Social Security of your change of address. The Social Security Administration handles Medicare enrollment. You can change your address by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) and speak to one of their representatives from Monday through Friday, from 7AM to 7PM. You can also visit the Social Security office nearest you and fill out a change of address form or visit them online at  Here’s what you need to know.

Here’s what you need to know.

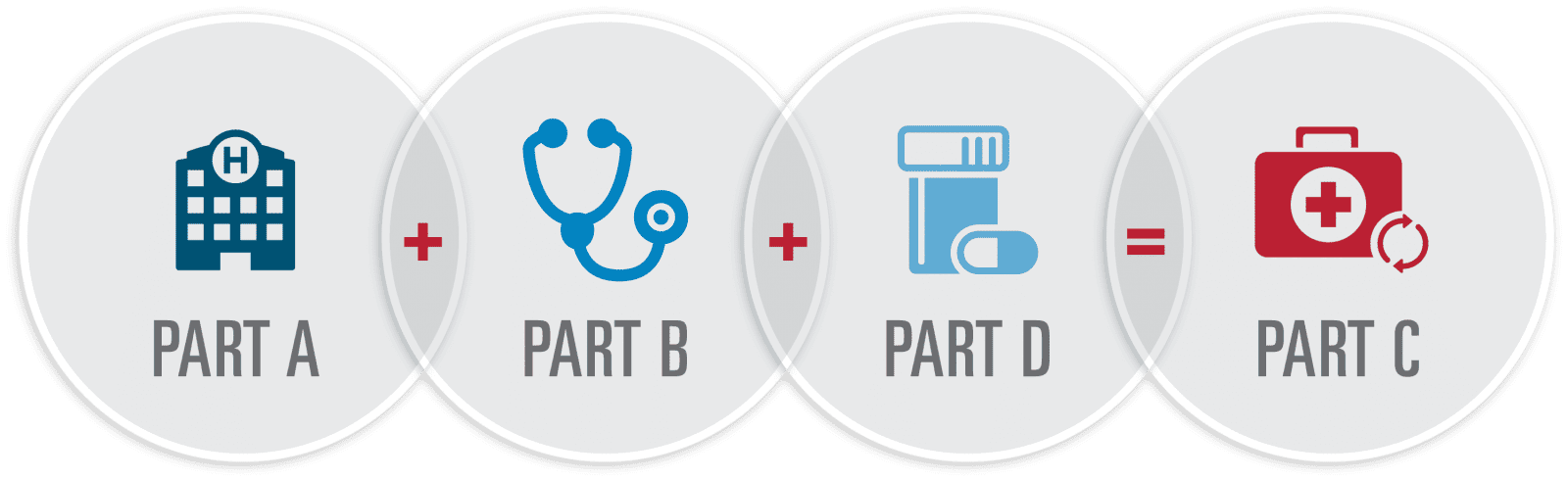

Yes. If you’re not retiring and you are continuing to work then you may want to consider enrolling in Medicare Part A and delaying Part B until you retire and leave your employer sponsored health insurance plan. Even if you’re not receiving Social Security benefits at age 65, you’re still eligible for full Medicare benefits. This includes the Part A (hospitalization), as well as Part B (doctors’ visits and outpatient care) and Part D (prescription drugs); you pay a premium for each. But if you are not collecting social security benefits then it’s up to you to contact Social Security to sign up for Medicare only. You must do this within your “initial enrollment period.” This period starts three months BEFORE the month you turn 65, includes the month you turn 65 and continues three months AFTER that — a seven-month period.

Yes. If you’re not retiring and you are continuing to work then you may want to consider enrolling in Medicare Part A and delaying Part B until you retire and leave your employer sponsored health insurance plan. Even if you’re not receiving Social Security benefits at age 65, you’re still eligible for full Medicare benefits. This includes the Part A (hospitalization), as well as Part B (doctors’ visits and outpatient care) and Part D (prescription drugs); you pay a premium for each. But if you are not collecting social security benefits then it’s up to you to contact Social Security to sign up for Medicare only. You must do this within your “initial enrollment period.” This period starts three months BEFORE the month you turn 65, includes the month you turn 65 and continues three months AFTER that — a seven-month period.