Goodbye Obamcare!

Here is what you need to know if you are turning 65 soon and making the move from Obamacare to Medicare…

Your transition from your health insurance plan on the healthcare.gov marketplace won’t be automatic, but moving to Medicare doesn’t have to be difficult.

For decades people have been transitioning from individual coverage or group plans offered by employers onto Medicare but if you enrolled through the healthcare marketplace exchange or “Obamacare” as it is most often called, the process is a little different – especially if you are receiving the monthly tax credits that lower your monthly premiums.

If you are collecting your Social Security or Railroad Retirement benefits prior to age 65, the government will automatically enroll you in Medicare the month you turn 65.

If not, you will have seven months to contact your nearest Social Security office and enroll in Medicare. Your initial enrollment period starts three months before the month you turn 65, the month you turn 65, and three months after, totaling seven months.

If not, you will have seven months to contact your nearest Social Security office and enroll in Medicare. Your initial enrollment period starts three months before the month you turn 65, the month you turn 65, and three months after, totaling seven months.

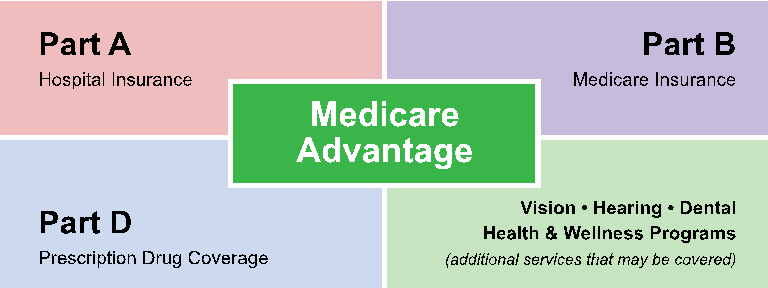

Most people pay no premiums for Medicare Part A, based on your work history. Medicare Part B has a monthly premium, which is $134 per month in 2017.

Beware: No automatic plan termination!

Prior to 2014, coverage in the individual market generally terminated automatically when you reached age 65. This changed under the Affordable Care Act. Now you need to contact the marketplace to cancel your coverage in order to make the move to Medicare.

Subsidies also end with Medicare eligibility.

You are not required to cancel your healthcare exchange insurance plan when you enroll in Medicare, but if you’re getting premium subsidies, they’ll end when you become eligible for Medicare.

Keeping an exchange plan might not be smart.

In almost every scenario, keeping your individual exchange plan along with Medicare would be a waste of money. The plans would provide duplicate coverage, and exchange plans are not set up to coordinate with Medicare.

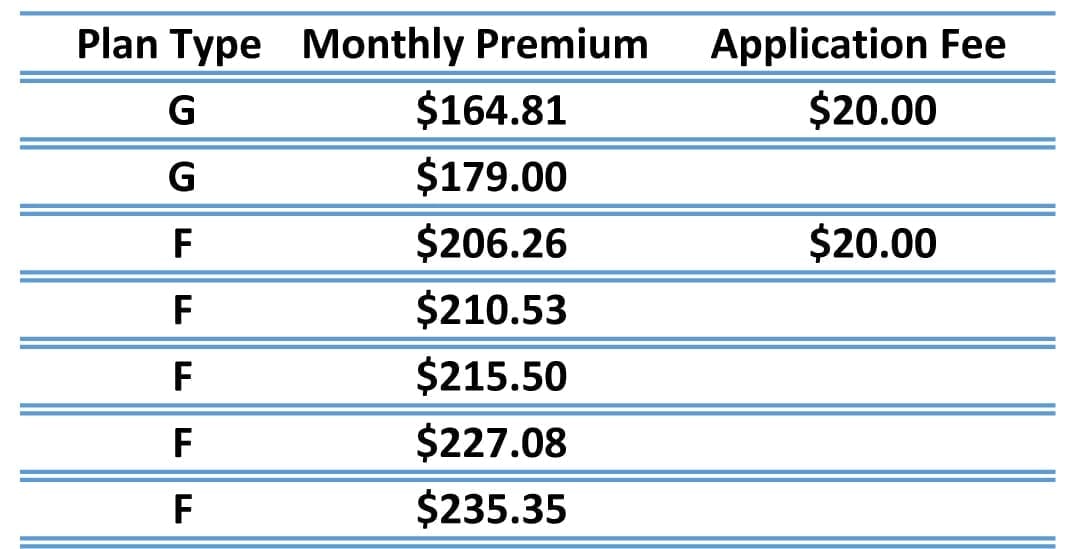

Plus the most expensive Medicare plans are around $200 per month and have no deductible or out of pocket costs. So if you’re thinking of keeping it because you’re very unhealthy it just doesn’t make sense.

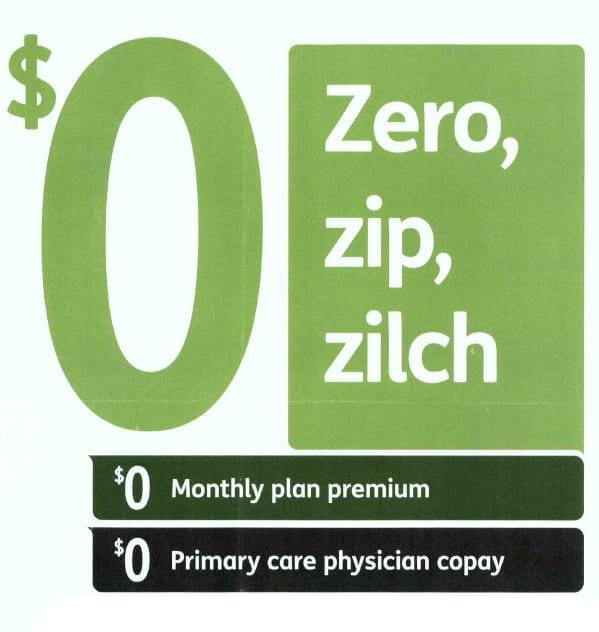

It makes even less sense if you are healthy! There are some plans that are actually $0 per month and have no deductible and the copays for doctors and specialists visits are very low. Ranging from $0 to $50.

When you’re ready to cancel your Obamacare health plan.

If you’re enrolled in a plan through HealthCare.gov, you can follow these directions for cancelling your plan so you can smoothly transition to Medicare. Or you can remove only yourself from the policy if you have other family members who need to stay on the exchange plan.

In Maine or New Hampshire, you’ll need to contact the Marketplace call center at 1-800-318-2596 or call your insurance agent or broker if you are working with one. If not, I can certainly help you. My number is 207-370-0143.

Helpful Tip: Cancelling your exchange coverage to switch to Medicare should be relatively simple, but I have seen cases where cancellation requests weren’t transmitted to the carrier in a timely manner. For that reason, I advise my clients to switch from bank draft to paper billing prior to submitting their cancellation request.

Helpful Tip: Cancelling your exchange coverage to switch to Medicare should be relatively simple, but I have seen cases where cancellation requests weren’t transmitted to the carrier in a timely manner. For that reason, I advise my clients to switch from bank draft to paper billing prior to submitting their cancellation request.

That way, if something goes wrong when the cancellation request is being processed, you won’t end up with premiums being automatically withdrawn from your bank account after your coverage was supposed to be terminated.

When should you cancel your plan?

My advice – to avoid any gaps in coverage – is to cancel call the Marketplace to cancel your plan 1 month before your Medicare begins. So if your Medicare starts January 1, you should schedule your exchange plan to terminate December 31st. It is best to call before the 15th of the month before you want your coverage to end.

Would you like my help?

If you would like to talk ask a question or schedule a meeting at your home or a nearby meeting place, you can call me directly at 207-370-0143 or use my simple form on the CONTACT page of this site to send an email message.

The best part about working with me is that it does not cost you anything to talk with me to discuss your options and review the plans that are available. I am paid by the insurance companies in the form of a commission when you enroll in a plan. You pay nothing.

And you will not pay any more than anyone else and you are under no obligation whatsoever to change your plan if you talk with me.

“My goal is to help people and I have found great joy in being able to offer my services to people who need my help.”

Be sure to read your Annual Notice of Change Letter (ANOC) that should arrive in the mail each year at the beginning of October to see how your plan is increasing – this may help you determine how much you need to budget in 2018 to cover the costs of coverage. [

Be sure to read your Annual Notice of Change Letter (ANOC) that should arrive in the mail each year at the beginning of October to see how your plan is increasing – this may help you determine how much you need to budget in 2018 to cover the costs of coverage. [

Last week, I was parked in a parking lot, returning phone calls in between appointments and saw these seagulls flying around foraging for food.

Last week, I was parked in a parking lot, returning phone calls in between appointments and saw these seagulls flying around foraging for food. Sure enough, after a while the solo gull discovered a treasure trove of something tasty nearby a dumpster.

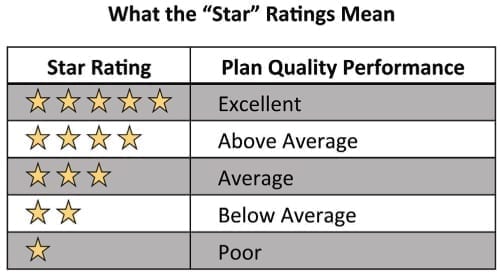

Sure enough, after a while the solo gull discovered a treasure trove of something tasty nearby a dumpster. Likewise, just because Medicare rates one plan higher than another, that ALSO does not mean it’s the best one for you.

Likewise, just because Medicare rates one plan higher than another, that ALSO does not mean it’s the best one for you.

Who gets one and what should you do with it?

Who gets one and what should you do with it? Fall Open Enrollment runs from

Fall Open Enrollment runs from

$0 Premium Medicare Advantage Plans do actually cost you nothing per month for the insurance plan and they also often times offer other services or generic prescriptions for $0 but these plans are not actually free.

$0 Premium Medicare Advantage Plans do actually cost you nothing per month for the insurance plan and they also often times offer other services or generic prescriptions for $0 but these plans are not actually free. However, $0-premium Medicare Advantage plans might not always be the most affordable option.

However, $0-premium Medicare Advantage plans might not always be the most affordable option.

Question:

Question:

Health Maintenance Organization (HMO) plans: These plans offer a network of doctors and hospitals that members are generally required to use to be covered. Because of this, HMOs tend to have strict guidelines, meaning that any visits and prescriptions are subject to the plan approval. If you use providers outside of the plan network, you may need to pay the full cost out of pocket (with the exception of emergency or urgent care). You generally need to get a referral from your primary care doctor to see a specialist.

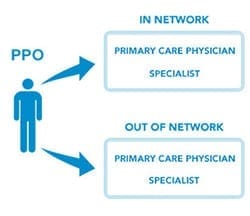

Health Maintenance Organization (HMO) plans: These plans offer a network of doctors and hospitals that members are generally required to use to be covered. Because of this, HMOs tend to have strict guidelines, meaning that any visits and prescriptions are subject to the plan approval. If you use providers outside of the plan network, you may need to pay the full cost out of pocket (with the exception of emergency or urgent care). You generally need to get a referral from your primary care doctor to see a specialist. Preferred Provider Organization (PPO) plans: Medicare Advantage PPO plans offer a network of doctors and hospitals for beneficiaries to choose from. Unlike an HMO, you have the option to receive care from health-care providers outside of the plan’s network, but you’ll pay higher out-of-pocket costs. Medicare Advantage PPOs don’t require you to have a primary care doctor, and you don’t need referrals for specialist care.

Preferred Provider Organization (PPO) plans: Medicare Advantage PPO plans offer a network of doctors and hospitals for beneficiaries to choose from. Unlike an HMO, you have the option to receive care from health-care providers outside of the plan’s network, but you’ll pay higher out-of-pocket costs. Medicare Advantage PPOs don’t require you to have a primary care doctor, and you don’t need referrals for specialist care.