Updated 2024 Medicare & You Handbook

Updated 2024 Medicare & You Handbook

Available online at: https://www.medicare.gov/index.php/medicare-and-you

Summary: The Medicare & You 2023 handbook is available free of charge. It’s published by the Centers for Medicare & Medicaid Services (CMS). This is the official government guide explaining the Medicare program in detail. You can get Medicare & You in a variety of formats. You can get the handbook in an electronic, PDF form or paper form and in English, Spanish, large print, Braille, or audio.

Medicare & You 2023 Handbook

Medicare & You 2023 is an official government publication. Millions of people receive the Medicare & You handbook at their homes by mail each year. CMS usually mails the Medicare & You handbook in the fall of each year. This is to help prepare people for the Annual Election Period, which occurs October 15th to December 7th each year. During this time, Medicare beneficiaries can review their Medicare coverage and make changes, if they want.

Frequently Asked Questions (FAQ)

I’ve had Medicare for a number of years. Why is the Medicare & You 2023 Handbook important to me?

Each year, the Centers for Medicare & Medicaid Services (CMS) publishes a revised Medicare & You Handbook. The purpose of the Medicare & You Handbook is to provide Medicare beneficiaries with up-to-date information about the Medicare program. If you’ve been enrolled in Medicare for a few years, you may want to use the Medicare & You 2023 as a reference guide to the current features of the Medicare program and your rights as a Medicare beneficiary.

What topics are included in the Medicare & You 2023 Handbook?

The Medicare & You Handbook contains information on

- Medicare Part A (hospital insurance)

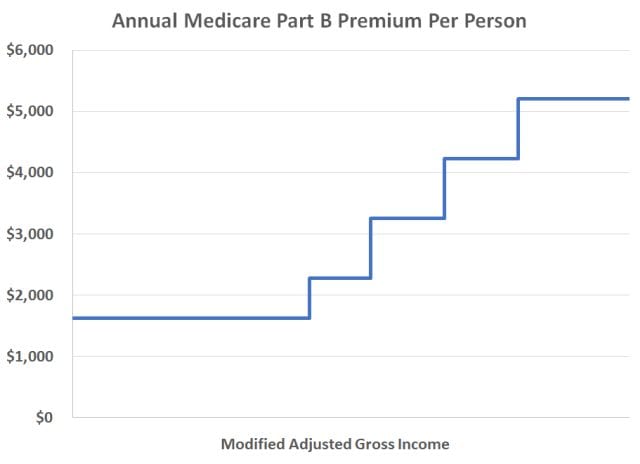

- Medicare Part B (outpatient/medical insurance)

- Medicare Supplement (Medigap) insurance

- Medicare Advantage plans

- Medicare Part D prescription drug coverage and the “donut hole”

- Medicare & You 2024 lists many Medicare-covered services. Also, the Medicare & You 2024 handbook has a chart comparing key features of

- Medicare Part A and Part B under the federal Medicare program with Medicare Advantage. Inside Medicare & You 2024 you’ll also find information on such topics as getting help with the cost of Part D prescription drug coverage, and much more.

What topics are not included in the Medicare & You 2024 Handbook?

Medicare & You 2024 doesn’t include plan-specific information – for example, when it comes to Medicare Advantage plans or Medicare prescription drug plans. If you have a Medicare Advantage or Medicare prescription drug plan, you’ll find plan-specific information in your plan’s 2022 Evidence of Coverage and Summary of Benefits. The Annual Notice of Change (ANOC) explains changes in the 2023 plan and benefits.

What if I didn’t get a Medicare & You 2023 handbook in the mail?

You can call Medicare at 1-800-MEDICARE (1-800-633-4227) 24 hours a day, 7 days a week. TTY/TTD users can call 1-877-486-2048. A Medicare representative can check your address on file and get a Medicare & You 2023 handbook mailed to your home.

Can I get the Medicare & You 2024 Handbook in other formats?

Yes. You can get an electronic version of Medicare & You 2024 from the Medicare website. In fact, if you want to “go green” as the kids say these days and inform Medicare you wish to receive communications electronically rather than by postal mail. You can download a PDF to your computer. Keep in mind Medicare & You is about 130 pages long. If you choose to keep it in an electronic format, you can find topics using key word searches and hyperlinks from the table of contents. You can get the Medicare & You 2024 handbook in English or Spanish. You can also download a copy of Medicare & You in large print or Braille. You can listen to audio podcasts of Medicare & You 2024 chapters. Finally, you can order paper or CD versions of Medicare & You by calling Medicare at 1-800-MEDICARE (1-800-633-4227) 24 hours a day, 7 days a week. TTY/TTD users can call 1-877-486-2048. You get Medicare & You free of charge.